Relocating to Cyprus and Applying for a Yellow Slip: What Do You Need?

We support you on your journey.

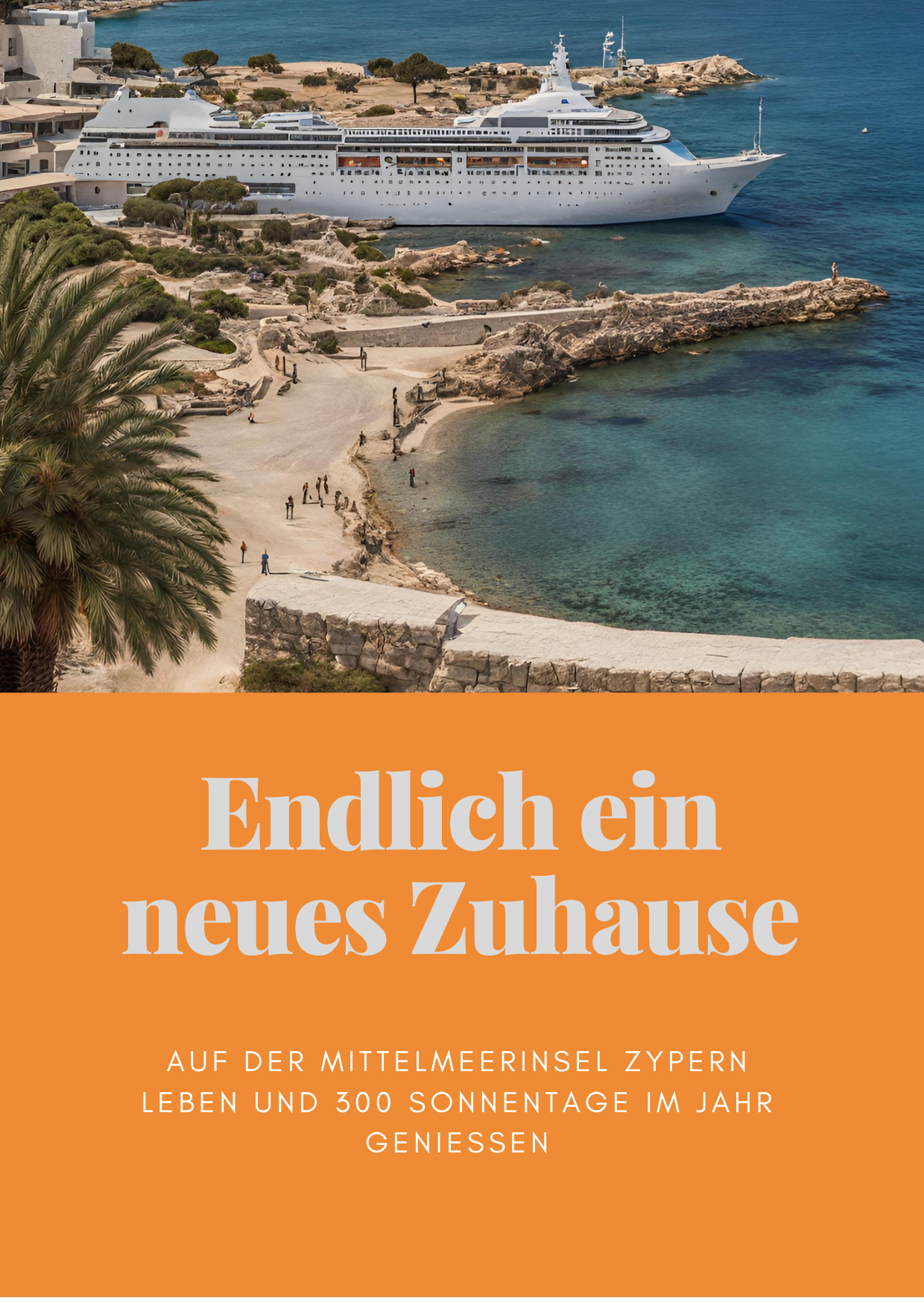

Do you dream of exchanging your daily routine for a new, exciting life abroad in the Greek part? If you are considering relocating to Cyprus – an island nation in the far eastern corner of the Mediterranean – then get ready: It’s time to gather information. This way, you will know what to expect. To ensure you have everything under control when planning and executing an international move, you should find out in advance which documents you need for emigration. The Republic of Cyprus is a tax paradise that is becoming increasingly popular with foreigners. However, there are a few things you should consider.

On this page, we will tell you what you need for relocating to Cyprus and what the Yellow Slip is, for example!

Relocating to Cyprus: An Overview

Relocating is an exciting yet challenging experience. It requires thorough planning, research, and a certain degree of adaptability. If you are considering relocating your residence to Cyprus within the European Union, here is an overview. The quality of life in Cyprus is high and attracts more and more expatriates each year. Here are some additional reasons that contribute to this:

- Weather: The island of Cyprus is known for its pleasant Mediterranean climate with warm summers and mild winters. This means plenty of sunshine and blue skies all year round, which is ideal for outdoor activities. Enjoy the island's beautiful beaches.

- Culture: Cypriot culture is a fascinating mix of Greek, Turkish, and British influences. This is reflected in the local cuisine, music, and art. The residents of Cyprus are also known for their hospitality and warmth.

- Leisure Activities: Cyprus offers a wide range of leisure activities. Whether you enjoy hiking in the Troodos Mountains, swimming, diving, skiing in winter, or visiting historical sites – there is always something to do. Additionally, numerous festivals and cultural events take place throughout the year.

- Cost of Living: The cost of living in Cyprus is generally lower than in many other European countries. This applies to rental prices as well as costs for groceries, public transportation, and leisure activities. However, please note that this varies depending on your lifestyle.

Step-by-Step Guide from a Professional

Relocating to Cyprus is an exciting endeavor. To ensure this process runs smoothly, it is important to be well-informed. Below, we offer a comprehensive step-by-step guide to help you realize your dream of living under the Cypriot sun with fascinating sights.

1. Entry Requirements for Relocating to Cyprus: ID Card or Passport

For entry into Cyprus, EU citizens require either a valid ID card or a passport. There are no other requirements. However, please note that the document must be valid for the entire duration of your stay in Cyprus. Additionally, EU citizens who wish to stay in Cyprus for longer than three months should apply for an EU residence permit. This is done with the Yellow Slip and regulates stays beyond the three-month period. This document grants citizens further rights (access to the healthcare system) and obligations (tax liability).

We recommend that you inform yourself early about the exact requirements and the application process, to ensure a smooth process. Before that, however, you will need a registration address. Please feel free to send us an email if you require further information.

2. Registration Address for Relocating to the Mediterranean Island

In addition to these important formal aspects, you also need a registration address in Cyprus. You can obtain this by either signing a 12-month rental agreement or purchasing property in Cyprus. The choice between these two options depends on your individual needs and plans. Ask yourself in advance: “Is a studio apartment sufficient for your current situation, or do I need something larger?” We would be happy to advise you on purchasing or finding a rental. The location is also crucial: Would you prefer to live in the capital Nicosia or in the coastal town of Paphos, near the Aphrodite monument?

3. Yellow Slips for the Whole Family: Documents with Three Options for Private Individuals

Are you an EU citizen considering relocating to Cyprus? Then you should know everything about the Yellow Slip before moving to Cyprus. This is a document that determines the status of your residence permit and, for example, ensures you access to public healthcare. The Yellow Slip is issued in three variants:

- For EU Employees Subject to Social Security Contributions

- For EU Visitors

- For Self-Employed Individuals

For EU citizens who wish to live in Cyprus, the Yellow Slip is an essential document. Without this residence permit, it is not possible to work legally on the island and reside permanently. We recommend that you apply for the Yellow Slip after purchasing property in Cyprus to avoid legal difficulties. If you engage an expert like BS-Holding, then the permit, non-dom status, and company formation in Cyprus will no longer be an issue. We will take care of the process. Our goal is to make your relocation to Cyprus completely stress-free. Do you have further questions? Please feel free to contact us or follow us on Facebook.

Cyprus Yellow Slip for EU Workers

The Yellow Slip is essential for your work permit in Cyprus. Whether you are employed by a company or wish to work in your own business – anyone who possesses the Yellow Slip for EU Workers can relocate to Cyprus with a permanent residence. For this, you must prove a minimum salary of €1,000. If other individuals (family members) are dependent on this salary, then a higher income is required. This is the simplest option! As soon as you receive the Yellow Slip, you can utilize the full range of services, and the healthcare system will also be open to you.

Required Documents for the Yellow Slip for EU Workers when Relocating to Cyprus

To obtain a Yellow Slip as an EU Worker, you must submit the following documents to the Cypriot authorities:

- Fully completed application form MEU1A

- Valid passport or ID card and a copy thereof

- Current confirmation from the Cypriot Social Insurance

- Company documents if you are employed by a company

- Private rental agreement (original and copy)

- A utility bill such as an electricity bill (original and copy)

Yellowslips for EU visitors

If you are an EU citizen without employment subject to social insurance, you must choose a special option to emigrate to Cyprus. This applies above all to people who generate income abroad or, for example, trade cryptocurrencies. For the Yellow Slip, they must submit certain proof of assets and their financial resources. Therefore, this option is not ideal for many wealthy people. However, we would be happy to advise you on the subject of living in Cyprus and find a solution together. When registering, you must provide the following documents:

- Valid passport or ID card including a copy

- Marriage certificate, divorce decree or death certificate and certified translation (EN or GR) including a copy

- Birth certificate of children including apostille, certified translation (EN or GR) and copy

- School enrolment of each child

- Purchase or rental agreement of a property including a copy

- Confirmation of health insurance

- Proof of income (pensions, rentals, other income) including translation (EN or GR)

- Bank statements for the last six months

Yellow Slip for self-employed persons

If you want to work in Cyprus as a self-employed person, there is also a special Yellow Slip in this case. With this, you do not necessarily need an LTD and can still operate legally in Cyprus. To do this, submit these documents:

- The completed MEU1A application

- A valid passport or ID card and a corresponding copy

- A current confirmation from the Cypriot Social Insurance and an advance payment of social security contributions of at least €700

The option of self-employment is the least favourable choice due to the high social security contributions and taxes. Experts advise to get well informed in advance. Also take the rental agreement including a copy with you so that you can ensure a smooth application. We are happy to advise you online and in our service centre. This way you know the differences between the Yellow Slips and choose the most attractive option. We provide you with extensive information. This way you know what terms like Non-Dom or Cyprus Limited mean. With us, emigrating to Cyprus is easier than ever!

What happens when emigrating to Cyprus after I have received the Yellow Slip?

Congratulations! You have received the coveted Yellow Slip! Now the question arises as to what to do next. As a passionate traveller, this opens up great opportunities for you to save taxes. For example, if you apply for a residence permit, you will benefit from an advantageous tax regulation (condition: you must spend between 60 and 182 days a year in Cyprus). To save more money as an entrepreneur, you can also open a Cyprus Limited structure. Here, the corporate tax is only 12.5%. This means that you can save a considerable sum after the company formation.

Emigrating to Cyprus is therefore an opportunity that you should not miss! With BS Holding, the process is also straightforward. We will help you apply for the Yellow Slip and other documents easily.

Establish Cyprus LTD after relocating

If you relocate to Cyprus and want to establish a Limited Company (LTD), there are some important aspects to consider. Cyprus is known for its favourable tax framework and the simple company formation process. After taking up residence in Cyprus, you can establish an LTD by first having a unique company name registered and preparing the necessary formation documents. These include:

- The articles of association of the company

- The Memorandum of Association

You must then submit the formation documents to the Department of Registrar of Companies and Official Receiver and pay the corresponding fee. Once your LTD is registered, you must ensure that you meet all ongoing legal and tax obligations. We recommend that you use the services of an experienced advisor. In this way, you ensure that all steps are carried out correctly and efficiently.

Taxes in Cyprus: Why are they considered particularly attractive?

Cyprus is known as an attractive destination for investors and entrepreneurs because it has favourable tax conditions. With low corporate and income tax rates as well as numerous benefits, Cyprus offers significant financial advantages for start-ups. Now we will shed light on why taxes in Cyprus are considered particularly attractive. Here are the main reasons:

Non-Dom status and 60-day rule in Cyprus

Cyprus offers attractive tax benefits for emigrants and international business people. Two of the most important aspects of the Cypriot tax system are the Non-Dom status and the 60-day rule.

The residence permit in Cyprus

The Non-Dom status in Cyprus offers an attractive way to save taxes. Persons who are resident in Cyprus but were not born there are considered “non-domiciled”. Foreign income is tax-free in this case under certain conditions. There is also no wealth tax. With these tax advantages, Cyprus offers an ideal option for interested parties who generate their income abroad and want to avoid a high tax burden.

60-day rule in Cyprus

The 60-day rule is an interesting alternative to the traditional 183-day option when determining tax residency. To benefit from this, you should meet certain conditions. For example, you must spend at least 60 days a year in Cyprus. Thanks to this regulation, you can take advantage of the Cypriot tax system without having to be present there all year round. This is a particularly advantageous option, especially for digital nomads, freelancers and international business people.

Low income tax

The country offers a low income tax and allows residents and companies to earn up to €19,500 per year tax-free. The maximum tax burden of 35% is still a good deal for most people – especially compared to other countries. Make Cyprus your emigration country if you are looking for a place with favourable tax benefits.

Attractive living conditions

Cyprus is known for its attractive lifestyle and its tax advantages, which make it an ideal place to live and work. The Mediterranean lifestyle, the pleasant climate and the peaceful community make it particularly attractive. In addition, Cyprus offers numerous exciting job opportunities – especially for young people and professionals. The island is family-friendly and has beautiful beaches and a sea that invites you to leisure activities. The cost of living in Cyprus is also favourable compared to many other countries. All in all, the high quality of life is therefore a decisive advantage.

Emigrate successfully with BS Holding

Emigrating to Cyprus is a dream for many Germans who seek the pleasant Mediterranean climate, rich culture, and relaxed way of life. Bundschuh & Schmidt Holding Limited (BS Holding) has established itself as a leading point of contact for relocation for all those who wish to take this step.

From initial consultation on immigration and visa processes to assistance with property search in picturesque cities like Paphos, Nicosia, and Limassol, BS Holding offers comprehensive services. However, a special focus is placed on the city of Paphos.

Our consultation by experienced tax advisors helps newcomers navigate the Cypriot tax system and handle everything necessary for a smooth registration. Furthermore, BS Holding also provides support in financial matters.

For example, we can help you open a bank account if you wish to relocate your main residence to the island in the Mediterranean. We also cover the topic of health – we advise you on the public health system Gesy and, if required, can also arrange private insurance for you.

Furthermore, we also offer assistance with language difficulties or bureaucratic hurdles. Apply with us for the Yellow Slip (the visa for EU citizens) or the Non-Dom status. So, quit your job and leave Germany.

Frequently Asked Questions

Why is Cyprus an attractive destination for emigrants?

Cyprus attracts emigrants with its favorable tax conditions, pleasant climate, beautiful beaches, and family-friendly environment. Furthermore, the cost of living is lower compared to many other European countries. Therefore, the country is also appealing to retirees.

How is the tax system in Cyprus structured for emigrants?

The Cypriot tax system is based on the residency principle. Individuals who reside in the country for at least 60 days per year may already be subject to tax. It offers a personal income tax exemption of 19,500 € and an attractive corporate tax rate of 12.5%. Particularly interesting is the so-called Non-Dom status, under which foreign income is tax-free.

What are the advantages of Non-Dom status in Cyprus?

This status in Cyprus offers significant tax advantages. However, it is important to note that income from abroad is generally not entirely tax-free. While there are possibilities for a 50% reduction, a complete tax exemption applies only to dividends and interest income. Nevertheless, the status in Cyprus still offers attractive benefits such as exemption from taxes on foreign income and, in certain cases, on dividends or interest income.

What should I consider if I want to emigrate to Cyprus?

You should rent an apartment immediately and apply for the Yellow Slip after receiving your first electricity bill. This is how you legally register on the island.

Are there special regulations for retirees who wish to emigrate to Cyprus?

Retirees can easily transfer their pension to Cyprus. Thanks to the coordination of the social security system through European law, there are no difficulties with the German pension insurance and the pension in Cyprus.

How does the healthcare system in Cyprus work, and how am I insured as an emigrant?

The Cypriot healthcare system is divided into public and private sectors and is administered by the Ministry of Health. All working residents, including immigrants, have access to social security. Additionally, there are affordable private options. Contact us to learn more.