Cyprus 60-Day Rule: Emigration

We explain what you need to consider when emigrating under the 60-day rule

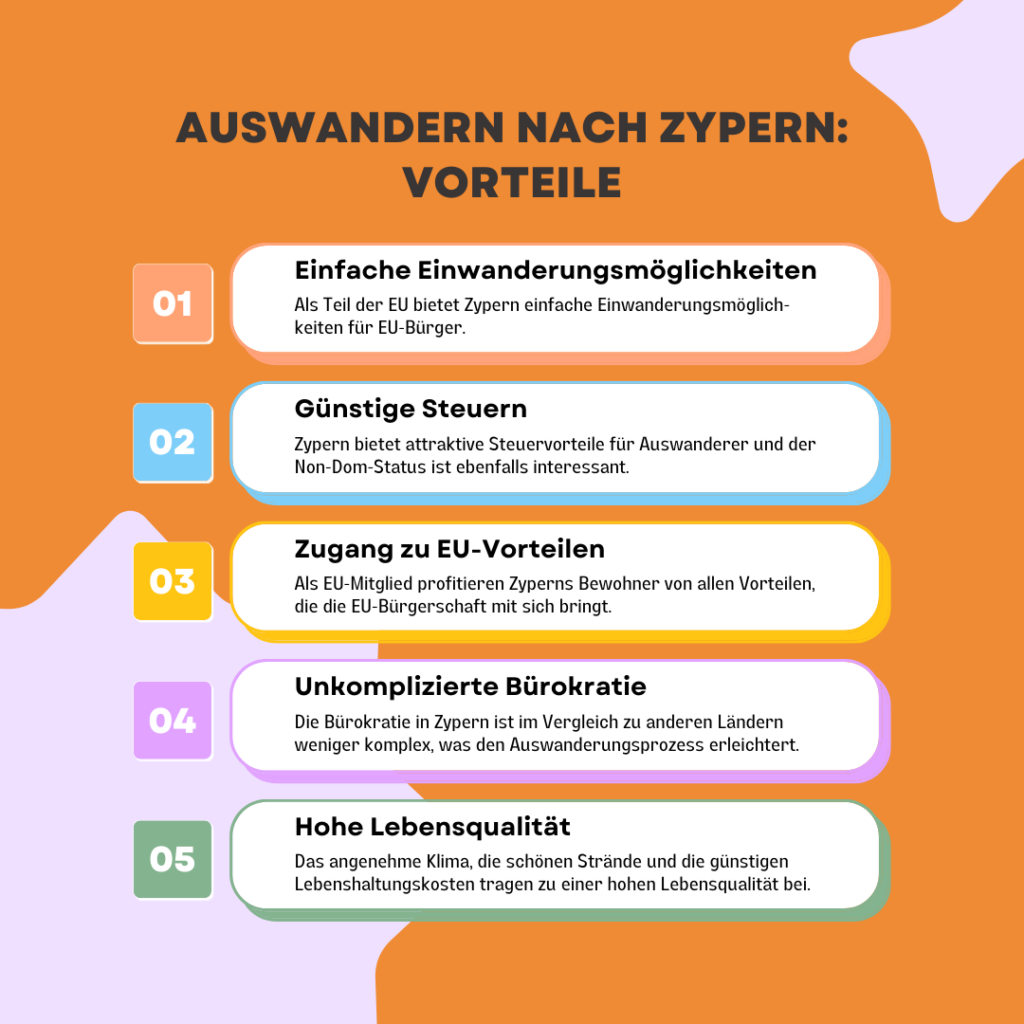

Are you considering starting a new life in a country with an excellent quality of life, exciting opportunities, fascinating sights, and an enviable Mediterranean climate? Then the island of Cyprus could be the perfect place for emigration. With the 60-day rule, entrepreneurs in particular save money. Learn why this aspect plays a role when emigrating to Cyprus.

The 60- and 183-Day Rules in Cyprus: Understanding Cypriot Laws

In Cyprus, you can become a tax resident after a minimum stay of more than 60 days thanks to the 60-day rule and take advantage of the benefits of the Cypriot tax system. However, several conditions must be met. This is stated in the law:

According to tax law, as of 2017, an individual is a tax resident in Cyprus if they meet either the "183-day" or the "60-day rule" for the tax year. Only for previous tax years is the "183-day rule" relevant for determining tax residency in Cyprus.

Individuals who spend more than 183 days per year in Cyprus are automatically considered tax residents in Cyprus and typically no longer need to file a tax return in Germany or Austria. No further conditions or criteria need to be observed. Therefore, emigrating to Cyprus without experts can sometimes be quite challenging. As an employer or employee, learn what is important for tax payments. As tax consultants, we explain what matters in this regard and how you can get the most out of your investments in various areas.

Conditions for Application

The option for Cyprus tax residency is met for individuals who cumulatively in the relevant tax year:

- do not reside in any other single state for a total period exceeding 183 days

- are not considered tax residents by any other state

- reside in Cyprus for at least 60 days (minimum stay, preferably consecutively)

- and have other defined Cyprus connections

To meet the fourth criterion, for example, as an entrepreneur, you must either operate a company, such as a Cyprus Ltd., with a permanent establishment during the tax year, be employed in Cyprus, or act as an office holder (director) in a company taxable in Cyprus. This must be the case throughout the entire tax year if you wish to emigrate to Cyprus. For tax benefits, after more than 60 days of stay in Cyprus during the tax year, you must either own a residential property or maintain a permanently rented one. If you emigrate for professional reasons, then investing in Cyprus is definitely worthwhile, as you save taxes.

The formation of an offshore company is also interesting. Feel free to contact us if you have questions about the Limited, dividend payments, and more.

Pay particular attention to this point: Not being considered tax resident by any other state

As a taxpayer and entrepreneur abroad, you must know where you are tax resident to avoid expensive fees. We often think we are resident in a country because we live or work there. However, the matter is more complex than one might assume. Every state has its own definition of tax residency. If you are recognized as a tax resident in another country, this can have significant implications for the taxes you have to pay.

High-tax countries like Germany (GmbH vs. Cyprus Limited) often have vaguely worded passages in their double taxation agreements for abroad. In case of doubt, the country of citizenship has the primary right to taxation despite emigration if one has ties there. This means that despite residing in another country, you could be taxable in a rented apartment. In that case, you would not benefit from a tax-free allowance or a low tax rate. However, there are several factors to consider when determining tax residency, so you have an alternative as a German citizen. These include:

- Center of vital interests

- Economic interests

- Domestic income

- Residency

If these factors are located in one country, one can be considered tax resident there upon emigration. However, be aware that regulations differ in various countries. Therefore, a prior comparison of the current situation is advisable. Furthermore, you will then have access to services such as the country’s healthcare system. To avoid conflicts, you should inform yourself about tax residency in advance and, if necessary, seek advice from a tax expert.

German Law: Emigrating to Cyprus with more than 60 days of stay per year

To understand the problem in more detail, we provide you with Article 4. The law provides the following information and details:

Article 4

Resident Person

(1) For the purposes of this Agreement, the term "resident of a Contracting State" means any person who, under the laws of that State, is liable to tax therein by reason of his domicile, residence, place of management or any other criterion of a similar nature, and also includes that State, its political subdivisions and local authorities. This term, however, does not include any person who is liable to tax in that State in respect only of income from sources in that State or capital situated therein.

(2) Where by reason of the provisions of paragraph 1 an individual is a resident of both Contracting States, then his status shall be determined as follows:

- 1. a) He shall be deemed to be a resident only of the State in which he has a permanent home available to him; if he has a permanent home available to him in both States, he shall be deemed to be a resident only of the State with which his personal and economic relations are closer (centre of vital interests);

- 2. b) if the State in which he has his centre of vital interests cannot be determined, or if he has not a permanent home available to him in either State, he shall be deemed to be a resident only of the State in which he has an habitual abode;

- 3. c) if he has an habitual abode in both States or in neither of them, he shall be deemed to be a resident only of the State of which he is a national;

- 4. d) if he is a national of both States or of neither of them, the competent authorities of the Contracting States shall settle the question by mutual agreement.

(3) Where by reason of the provisions of paragraph 1 a person other than an individual is a resident of both Contracting States, then it shall be deemed to be a resident only of the State in which its place of effective management is situated.

This is current information, verified on 2023-09-17 for Cyprus. Citizenship can therefore play a crucial role , whether you are taxable in a particular country after emigration or not. This is particularly important when it comes to your home country. If you desire tax liability in Cyprus, you should therefore spend less than 183 days in your country of citizenship. It is not an option to live only 60 days in Cyprus and the rest of the year in Germany. For example, you would continue to pay income tax on a salary. If you spend only 60 days in Cyprus, you should be in Germany for a maximum of 40–50 days to maintain your tax liability in Cyprus, for example, as a trader of cryptocurrencies.

Consider these factors and obtain the correct information for the application so that you only pay Cyprus taxes. Only then will you get the most out of the tax system.

How to calculate the 60-day rule

If you wish to live in Cyprus or emigrate for professional reasons, you must know the rules for calculating days of stay. We provide you with the information you need as an emigrant. The days are calculated as follows:

- The day of departure from Cyprus counts as a day of stay outside Cyprus

- The day of arrival in Cyprus counts as a day of stay in Cyprus

- Arrival and departure from Cyprus on the same day count as one day of stay in Cyprus

- Departure from and arrival back in Cyprus on the same day count as one day of stay outside Cyprus.

Rescue your business from crisis and save on taxes in Cyprus!

Benefit from attractive tax regulations and a high quality of life in Cyprus. Our experienced team will navigate you through the complex tax jungle and help you effectively reduce your tax burden. Cyprus offers not only tax advantages but also a pleasant climate, beautiful beaches, and a vibrant culture. We also reveal how you can, for example, establish an LTD.

What the 60-Day Rule has to do with Non-Dom Status

If you wish to emigrate to Cyprus, the tax legislation can often be complex and confusing. In connection with the 60-day rule, the term “Non-Dom Status” is also frequently mentioned. But what do these aspects have to do with each other?

What is Non-Dom Status?

The term Non-Dom stands for “non-domiciled”. This concept refers to individuals who have their tax residency in a particular country. They were not born there and do not permanently reside in that state. Non-Dom status offers various tax advantages, especially in countries like Cyprus.

The advantages of Non-Dom status are significant. For example, foreigners in Cyprus who obtain it can receive their capital gains tax-free. This makes Non-Dom status particularly attractive for high-net-worth individuals and companies (Cyprus Limited) who wish to relocate their tax residency for professional reasons. In this way, you increase your profits with a Cyprus company.

The 60-Day Rule

The rule is an essential part of the Non-Dom status provisions for taking up residence in Cyprus. It states that one must be on the Mediterranean island for more than 60 days a year to obtain Non-Dom status. This rule allows people who travel frequently or have multiple residences to benefit from the tax advantages of Non-Dom status in Cyprus. You do not have to settle permanently in the country for this. However, be aware that an exit tax may apply if you plan to return to your place of residence in Germany afterwards.

Non-Dom Status and 60-Day Rule: a Dynamic Duo

Together, Non-Dom status and the 60-day rule form a powerful duo that can offer significant tax advantages. With this rule, individuals can obtain Non-Dom status without having to spend most of the year in Cyprus. This way, you save taxes and maximize your income after establishing a company in places like Paphos or Limassol. Ensure that you meet all required legislative requirements. Furthermore, you should seek professional advice to maximize the benefits and ensure compliance with applicable laws. There are several aspects to consider if you wish to return to your place of residence.

Do you need help with immigration?

Are you looking for a better life with more financial freedom, flexibility, and security? Emigrating to Cyprus has never been easier! Don’t worry and benefit from tailored consultations. Live on the dreamlike Mediterranean island that captivated even the gods! Here you can even communicate in English. As tax consultants (according to Article 4 StBerG), we assist you with your emigration. We even search for your dream property in Cyprus!

Guaranteed Preparation for Emigration to Cyprus (EU) and Tax Savings

Bundschuh & Schmidt supports you not only in the initial phase of emigration. It doesn’t matter whether you are an employed person or an entrepreneur. Our highly qualified specialists assist you in developing strategies for tax optimization, asset management, estate planning, and asset diversification. With the 60-day rule, you can save taxes as an entrepreneur or digital nomad and live in a holiday paradise. Seize the opportunity to invest in your future and learn more today about the advantages of living in Cyprus. These include, for example, comparatively low cost of living. No matter whether you want to move for private or professional reasons – we will help you!

We can even rent a car for you upon arrival and search for properties. Simply contact us via our email address or contact form.